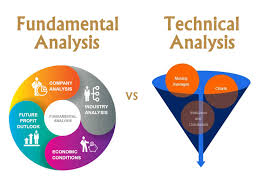

Technical Analysis vs Fundamental Analysis

In the realm of trading and investing, technical analysis vs fundamental analysis are the two main methods used to evaluate the markets and come to wise decisions. These two approaches give investors different viewpoints and concentrate on different facets of the market, giving them a thorough grasp of the variables influencing asset prices.

What is technical analysis?

Technical analysis is the study of market data, primarily focused on chart patterns, indicators, and price action. Technical analysts examine historical price movements, trading volumes, and other market-related data to identify trends, support and resistance levels, and potential trading opportunities. The goal of technical analysis is to predict future price movements based on past patterns and market behavior.

Technical analysts use tools such as candlestick charts, moving averages, oscillators, and various other indicators to analyze the market. They look for patterns, trends, and signals that can provide insights into the potential direction of the market or a specific asset. By understanding the psychology of market participants and the dynamics of supply and demand, technical analysts aim to make informed trading decisions.

What is fundamental analysis?

Fundamental analysis, on the other hand, focuses on the underlying factors that influence the intrinsic value of an asset, such as a company’s financial performance, economic conditions, industry trends, and management quality. Fundamental analysts delve into the news, financial reports, and economic data to assess the overall health and potential of a company or an entire market.

Fundamental analysis is concerned with understanding the true worth of an asset based on its underlying fundamentals. Investors who employ fundamental analysis aim to identify undervalued or overvalued assets and make long-term investment decisions accordingly. They seek to understand the factors that drive the market and the specific asset, rather than relying solely on historical price movements.

The Differences in Approach

The primary difference between technical analysis and fundamental analysis lies in their focus and time horizons. Technical analysis is primarily concerned with the short-term movements of the market, aiming to identify trading opportunities within a matter of minutes, hours, or days. Technical analysts believe that the market’s behavior can be predicted based on past patterns and trends.

In contrast, fundamental analysis takes a longer-term view, focusing on the underlying factors that influence the intrinsic value of an asset. Fundamental analysts seek to understand the overall health and potential of a company or market with the goal of making investment decisions that can yield returns over the course of months, years, or even decades.

The Complementary Nature of the Approaches

While technical analysis and fundamental analysis may seem like opposing approaches, they can actually be used in a complementary manner. Many successful investors and traders employ a combination of both methodologies to gain a more comprehensive understanding of the market and make more informed decisions.

Technical analysis can provide insights into short-term price movements and potential trading opportunities, while fundamental analysis can help identify the underlying factors that may influence the long-term performance of an asset. By combining these two approaches, investors can make more well-rounded decisions and potentially improve their overall investment or trading outcomes.

Conclusion

Technical analysis and fundamental analysis are two distinct approaches to understanding and navigating the financial markets. While they differ in their focus and time horizons, they can be used in a complementary manner to provide a more comprehensive understanding of the factors driving asset prices. By combining these two methodologies, investors can make more informed decisions and potentially improve their investment or trading outcomes.

FAQ

-

What is the primary focus of technical analysis?

Technical analysis focuses on the study of market data, such as price movements, trading volumes, and chart patterns, to identify trends and make trading decisions.

-

What is the primary focus of fundamental analysis?

Fundamental analysis focuses on the underlying factors that influence the intrinsic value of an asset, such as a company’s financial performance, economic conditions, and industry trends.

-

Can technical analysis and fundamental analysis be used together?

Yes, many investors and traders use a combination of technical analysis and fundamental analysis to gain a more comprehensive understanding of the market and make more informed decisions.

-

What is the typical time horizon for technical analysis?

Technical analysis is primarily focused on the short-term movements of the market, with the goal of identifying trading opportunities within a matter of minutes, hours, or days.

-

What is the typical time horizon for fundamental analysis?

Fundamental analysis takes a longer-term view, focusing on the underlying factors that can influence the intrinsic value of an asset over the course of months, years, or even decades.

Follow https://www.digitalpluto.co.in/ for the latest updates about the stock market.