How to Pick Stocks in 10 Minutes: on the Groww App

Retail participation in the stock market has increased in the quickly changing investment landscape of today, as evidenced by the tripling of the total number of Demat accounts between March 2023 and April 2024. The public’s growing faith in India’s growth story is reflected in the rise in retail investment. Many investors, however, still find it difficult to understand the complexities of stock analysis and market jargon, and they frequently rely on dubious sources like stock tips and WhatsApp groups. In this comprehensive blog, we’ll explore how you can leverage the Groww app to analyze and pick stocks in just 10 minutes without getting bogged down by the technical aspects of investing.

Table of Contents

- Navigating the Groww Platform

- Step 1: Analyze Historical Stock Performance

- Step 2: Explore Expert Ratings

- Step 3: Analyze Key Financial Ratios

- Step 4: Review Financial Growth

- Step 5: Understand Shareholding Pattern

- Step 6: Analyze Mutual Fund Holdings

- Step 7: Compare with Peers

- Conclusion

- FAQ

Navigating the Groww Platform

When you log in to the Groww app, you’ll be greeted with a user-friendly interface that provides a wealth of information about the market. The home screen displays real-time market updates and tickers, making it easy to stay informed about the latest developments.

Step 1: Analyze Historical Stock Performance And Pick Stocks in 10 Minutes

When you search for a company on the Groww app, you’ll be presented with a stock price chart that showcases the daily and historical stock price movements. While past performance does not guarantee future results, this information can provide valuable insights into the company’s prospects and help you understand the overall market sentiment.

Step 2: Explore Expert Ratings

As you scroll down, you’ll find the “Expert Ratings” section, which gives you a glimpse into what analysts think about the stock. This can help you gauge the overall sentiment and recommendations for the company, whether it’s a buy, sell, or hold recommendation.

Step 3: Analyze Key Financial Ratios in 10 Minutes

One of the most crucial aspects of stock analysis is understanding the company’s valuation. The Groww app provides a comprehensive overview of the company’s key financial ratios, such as market capitalization, earnings per share (EPS), price-to-earnings (P/E) ratio, dividend yield, debt-to-equity ratio, return on equity (ROE), and price-to-book ratio. By analyzing these metrics, you can gain valuable insights into the company’s financial health and its relative valuation compared to its peers.

Step 4: Review Financial Growth in 10 Minutes

The Groww app also offers a detailed analysis of the company’s financial performance, including revenue, profit, and net worth trends over the last 5 quarters and 5 years. This information can help you identify the company’s growth trajectory and assess its overall financial health.

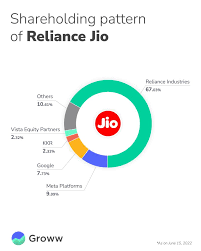

Step 5: Understanding Shareholding Pattern And Picking Stocks in 10 Minutes

The shareholding pattern of a company can provide valuable insights into the confidence of key stakeholders, such as promoters, foreign institutional investors (FIIs), and domestic institutional investors (DIIs). A strong promoter holding or increasing stake from FIIs and DIIs can be seen as a positive indicator for the company’s future prospects.

Step 6: Analyze Mutual Fund Holdings And Pick Stocks In 10 Minutes

The Groww app also allows you to see which mutual fund companies have invested in the stock you’re analyzing. This information can be useful, as institutional investors often conduct thorough research before making investment decisions.

Step 7: Compare with Peers

Finally, the Groww app provides a “Similar Stocks” section, which allows you to compare the company you’re analyzing with its competitors or other companies in the same sector. This can help you understand the company’s relative valuation and performance compared to its peers.

Conclusion

By leveraging the features of the Groww app, you can now analyze and pick stocks in just 10 minutes without getting bogged down by the complexities of stock market jargon. Remember, while this quick analysis can provide a solid foundation for your investment decision, it’s essential to dive deeper into the company’s business, management, and long-term growth potential before making any investment decisions.

FAQ: How to Pick Stocks in 10 Minutes

-

What is the key feature of the Groww app that helps with stock analysis?

The Groww app provides a comprehensive overview of a company’s financial ratios, historical performance, expert ratings, shareholding pattern, and peer comparison, all in a user-friendly interface.

-

We can analyze a stock in 10 minutes on the Groww app.

With the Groww app, you can analyze a stock in just 10 minutes without getting bogged down by the technical aspects of investing.

-

What are the key financial ratios I should look at when analyzing a stock?

The Groww app provides access to key financial ratios such as market capitalization, earnings per share (EPS), price-to-earnings (P/E) ratio, dividend yield, debt-to-equity ratio, return on equity (ROE), and price-to-book ratio.

-

How can the shareholding pattern of a company help in my investment decision?

A strong promoter holding or increasing stake from FIIs and DIIs can be seen as a positive indicator for the company’s future prospects, as it suggests that the key stakeholders are confident in the company’s growth.

-

Why is it important to compare the company with its peers?

Comparing the company’s valuation and performance with those of its competitors or other companies in the same sector can help you understand the company’s relative position and identify any potential undervaluation or overvaluation.

Follow https://www.digitalpluto.co.in/ for the latest updates about the stock market.