6 Best Renewable Energy Stocks

India wants to reach 500 gigawatts of renewable energy capacity by 2030, and the sector is growing at an incredible rate. Investors now have a great chance to take advantage of the sector’s potential. In this article, we will explore the 6 best renewable energy stocks that could deliver exceptional returns in the coming years.

1. KP Energy Limited

KP Energy Limited is a leading provider of high-quality wind turbine generator solutions for wind farm projects in Gujarat. The company offers a range of services, including the development of wind power projects, and has an order book exceeding ₹500 crore. In the past, this stock has delivered impressive returns, with 428% in 1 year, 222% in 3 years, and 66% in 5 years. With a market capitalization of ₹2,774 crore and a price-to-earnings ratio of 47, the stock is currently trading at a premium valuation. However, it has the potential to continue its strong performance in the coming years.

2. IREDA: Best Renewable Energy Stocks

IREDA is a company that provides promotion, development, and financial services for renewable sources of energy. The company has a loan sanction amount of ₹3,735.68 crore and has seen decent growth in both sales and profits over the past 5 years. As a relatively new listing, with only 6-7 months since its IPO, the stock has the potential to deliver substantial returns in the coming years. Currently trading at ₹177, the stock is down 15% from its recent highs, making it an attractive entry point for investors.

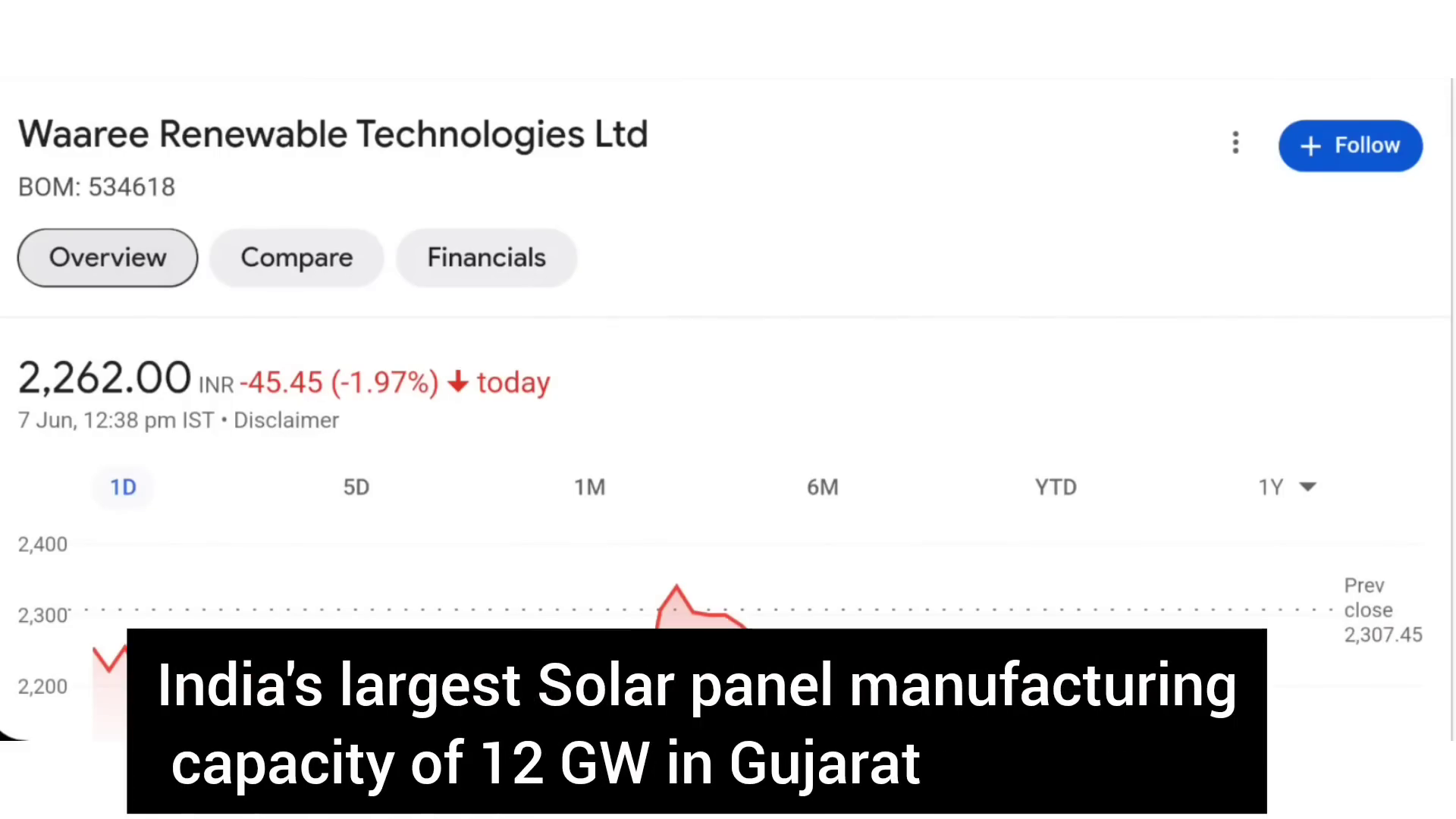

3. Waaree Renewable Technologies Limited: Renewable Energy Stocks

Waaree Renewable Technologies Limited is one of the most famous stocks in the renewable energy sector, having delivered exceptional returns that few other stocks can match. Many investors have made substantial profits from this stock, including myself, although I had to sell my holdings earlier than I would have liked due to not knowing how much the stock would continue to rise. Going forward, a minimum holding period of 3 years is recommended, as it is difficult to predict which stock will become a “rocket” in the market. In the past 3 years, this company has achieved a compound annual profit growth of 303%, and in the past 5 years, it has grown by 145%—a remarkable feat. The company’s key advantage is its 12 GW of India’s largest solar panel manufacturing capacity in Gujarat.

4. NHPC Limited

NHPC Limited is India’s single largest hydropower plant operator, with a generation capacity of 5,000 MW, which is expected to reach 25,000 MW by 2030. The company has recently secured several large orders, which is a positive sign for its future performance. Despite being a public sector undertaking, the stock has delivered impressive returns of 244% in the past year, as investors see significant growth potential in the company. Currently trading at ₹131, the stock is down around 13% from its recent highs and has strong support at the ₹120 level, indicating that it may continue its upward trajectory towards ₹140-150 in the coming days.

5. KA Group Energy Limited

KA Group Energy Limited is a growing and impressive company that has been in business since 2008, operating in the solar and wind-solar hybrid power project segment. The company recently received 20 new orders for solar power projects, a positive development that bodes well for its future. The stock has delivered multi-bagger returns in the past, and with the company’s strong performance, it has the potential to continue its upward trend. Currently, the stock is trading at a P/E ratio of 67, which is slightly on the higher side, but the company’s return on capital employed and return on equity are both above 20%, indicating its strong financial health.

6. IWTL

IWTL is a company that manufactures wind turbine generators and provides wind energy solutions. The company has returned to profitability after being in losses, and I believe it has good growth potential going forward. Compared to other energy stocks, this stock has underperformed, which means the potential returns could be attractive. The company has received several large orders, including a 1,500 MW contract from SECI and a 210 MW repeat order from ReNew Power, suggesting a bright future ahead.

CONCLUSION

In conclusion, the renewable energy sector presents a compelling investment opportunity, and the stocks highlighted in this article are well-positioned to capitalize on the industry’s growth. By investing in these stocks, investors can potentially generate substantial returns in the coming years. As always, it’s essential to conduct your own research, understand the risks, and invest according to your financial goals and risk tolerance.

FAQ: 6 Best Renewable Energy Stocks

- What are the best renewable energy stocks to invest in?

The six stocks highlighted in this article—KP Energy Limited, IREDA, Waaree Renewable Technologies Limited, NHPC Limited, KA Group Energy Limited, and IWTL—are considered some of the best renewable energy stocks to invest in based on their growth potential, financial performance, and industry positioning.

- Why should I invest in renewable energy stocks?

The renewable energy sector is experiencing rapid growth, and the Indian government’s target of 500 GW of renewable energy capacity by 2030 presents a significant opportunity for investors. These stocks have the potential to deliver exceptional returns in the coming years as the sector continues to expand.

- How much should I invest in renewable energy stocks?

The amount you should invest in renewable energy stocks will depend on your risk tolerance, investment horizon, and overall portfolio diversification. It’s generally recommended to start with a smaller allocation and gradually increase it as you gain more confidence in the sector and the individual stocks.

- What are the risks associated with investing in renewable energy stocks?

Renewable energy stocks, like any other stocks, are subject to market volatility and risks. Factors such as changes in government policies, technological advancements, and competition can impact the performance of these stocks. It’s important to do thorough research and diversify your investments to mitigate these risks.

Follow https://www.digitalpluto.co.in/ for the latest updates about artificial intelligence.