6 Fastest Growing Chemical Stocks

For investors looking for steady, long-term growth, the chemical industry has emerged as a promising sector in the ever-changing world of the stock market. A number of chemical companies have shown incredible resilience and performance as the world economy continues to recover from recent challenges. This post will examine 6 of the fastest-growing chemical stocks that are currently trading at favorable prices and could yield significant returns in the years to come.

1) Deepak Nitrite Limited

Deepak Nitrite Limited is a well-established chemical company that has been in the industry since 1970. The stock is currently trading at around ₹2,186 and is available at a good support zone. The stock made its all-time high in October 2021 and has not touched those levels since then, but it is expected to see a good uptrend in the coming months. The long-term trend for this stock is bullish, and it has the potential to deliver returns of over 40% if it crosses its all-time high levels.

The company’s business segment is solid, and its management is excellent. Furthermore, the FMCDA has increased its stake in the company, indicating that the stock is a good long-term investment. With a high return on capital employed (ROCE) and return on equity (ROE), a debt-free balance sheet, and ₹290 crore in free cash flow, this stock is worth considering for your portfolio.

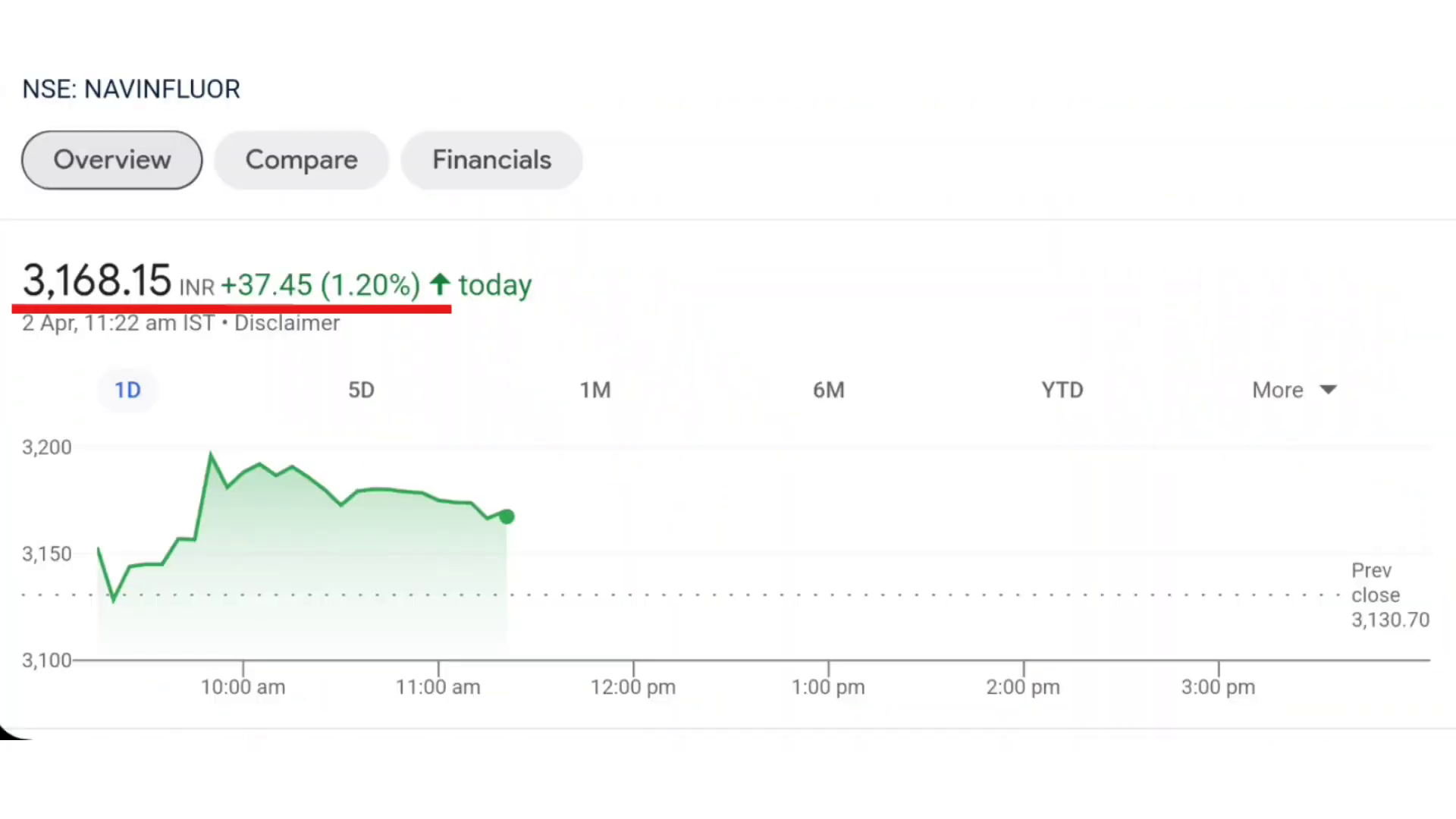

2) Navin Fluorine International Limited: Fastest-Growing Chemical Stocks

Navin Fluorine International Limited is a well-established and experienced company, and it is one of the largest specialty fluorochemical companies in India. The stock is currently trading at ₹3,168 and has not provided any returns in the last year, having corrected by around 25%. However, the stock is currently available at a 33% discount from its 52-week high, making it an attractive investment opportunity.

This stock is a good long-term investment, as it has a strong business segment and is a player in the refrigerant gas segment as well. In the last quarter, the FMCDA increased its stake in the company, and public shareholders have also increased their holdings, indicating that the company’s fundamentals are strong. Additionally, the stock’s price-to-earnings (P/E) ratio has come down from 85 to 53, suggesting that the company’s profitability has improved, and a quick recovery in its numbers is expected.

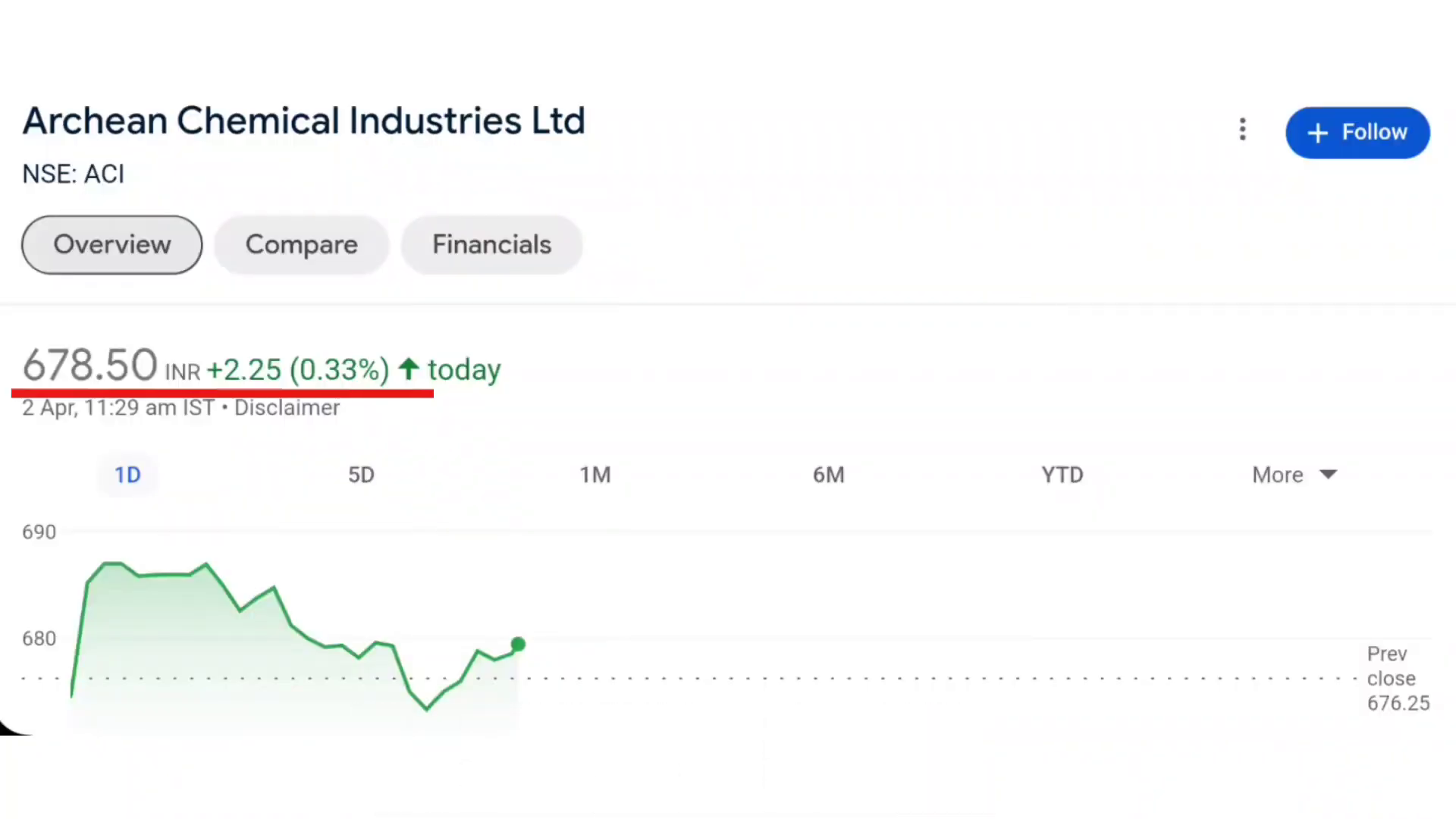

3) Archean Chemical Industries Limited

Archean Chemical Industries Limited is one of the leading exporters of bromine and industrial salt and is a leading specialty marine chemical manufacturer in India. The stock is currently trading at ₹678 and has provided 27% returns since its listing in November 2022.

The stock has strong support at the ₹600 level, and it has taken support at this range multiple times in the past before bouncing back. Last month, the stock saw a good breakout and provided 30% returns in just 10 days, and then it made a 52-week high of ₹837 before seeing some profit-booking. However, the buyers have again become active in the stock, and it is currently available at good buying levels.

The company is a leader in its business segment, and its products have strong demand. If the stock manages to strongly break the support levels, it can quickly move towards the ₹800 mark, and even in case of market pressure, it can find support at the ₹620 and ₹600 levels.

4) Finotouch Chemicals Limited

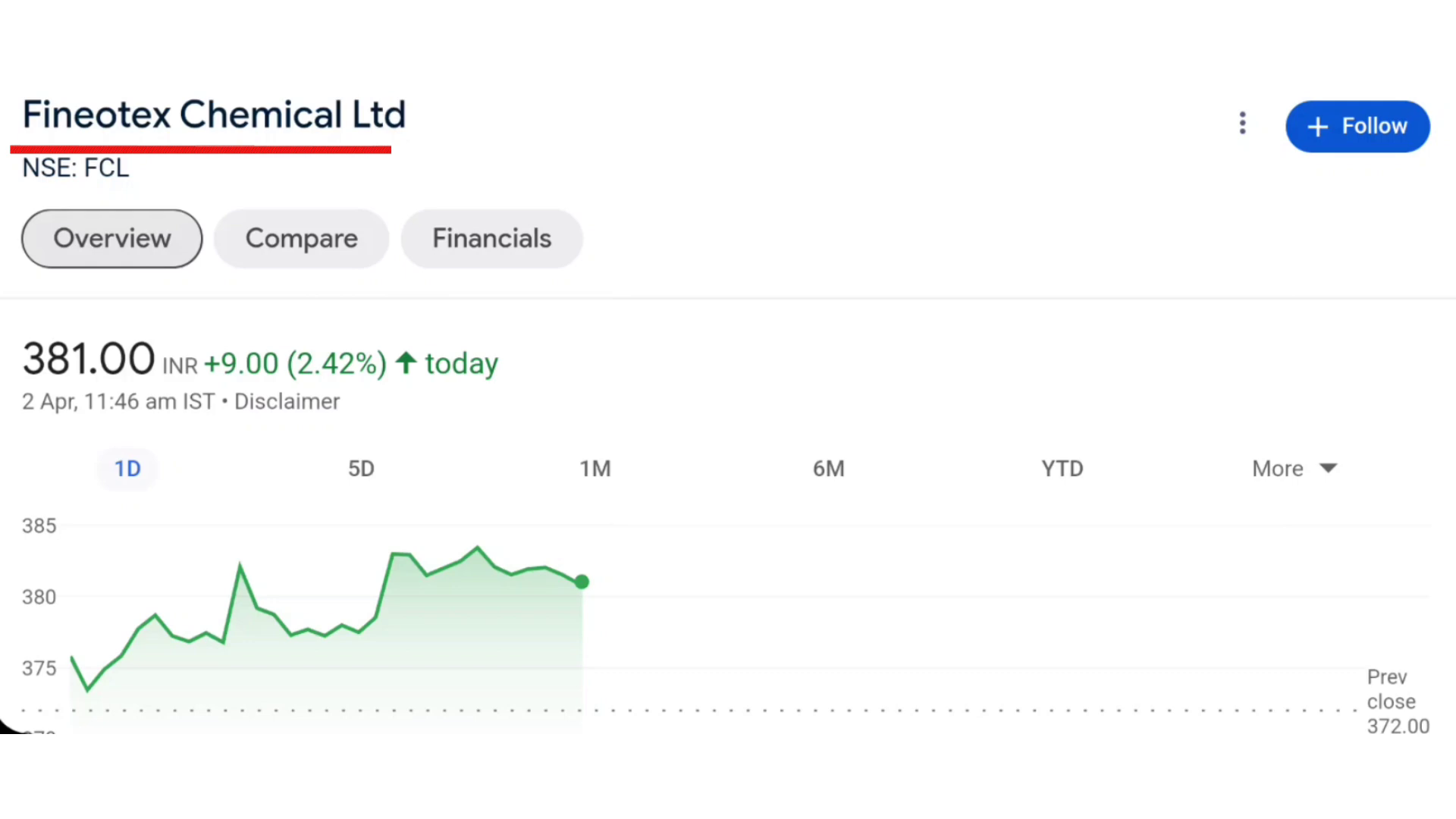

Finotouch Chemicals Limited is a fast-growing chemical company that has been in the business since 1979 and is a strong player in the textile chemical segment. The company manufactures over 400 products and has top companies like Gokaldas Exports, Reliance Industries, and Deepak Fertilizers as its clients.

The stock is currently trading at ₹381 and is available at good buying levels. The stock is trading at a P/E ratio of 35, which is reasonable considering its excellent return on capital employed (ROCE) and return on equity (ROE). The company is also debt-free and has a free cash flow of ₹402 crore, which is a positive sign.

The company’s numbers have been improving on a year-on-year basis, and the institutional investors have also increased their stake in the company, which is a positive sign. This stock can be a good long-term investment, as it has the potential to generate substantial returns.

5) New Age Chemicals Limited: Chemical Stocks

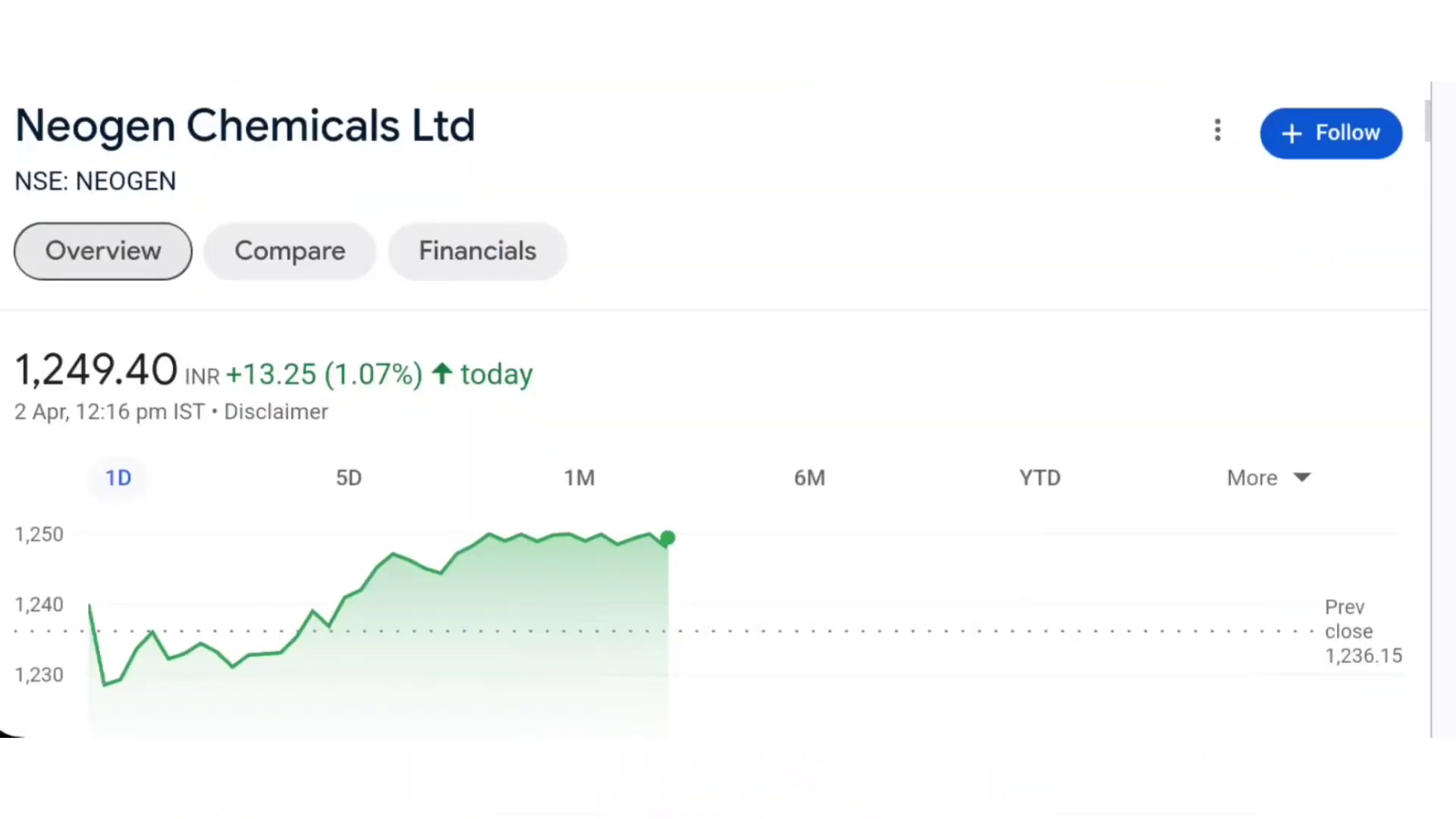

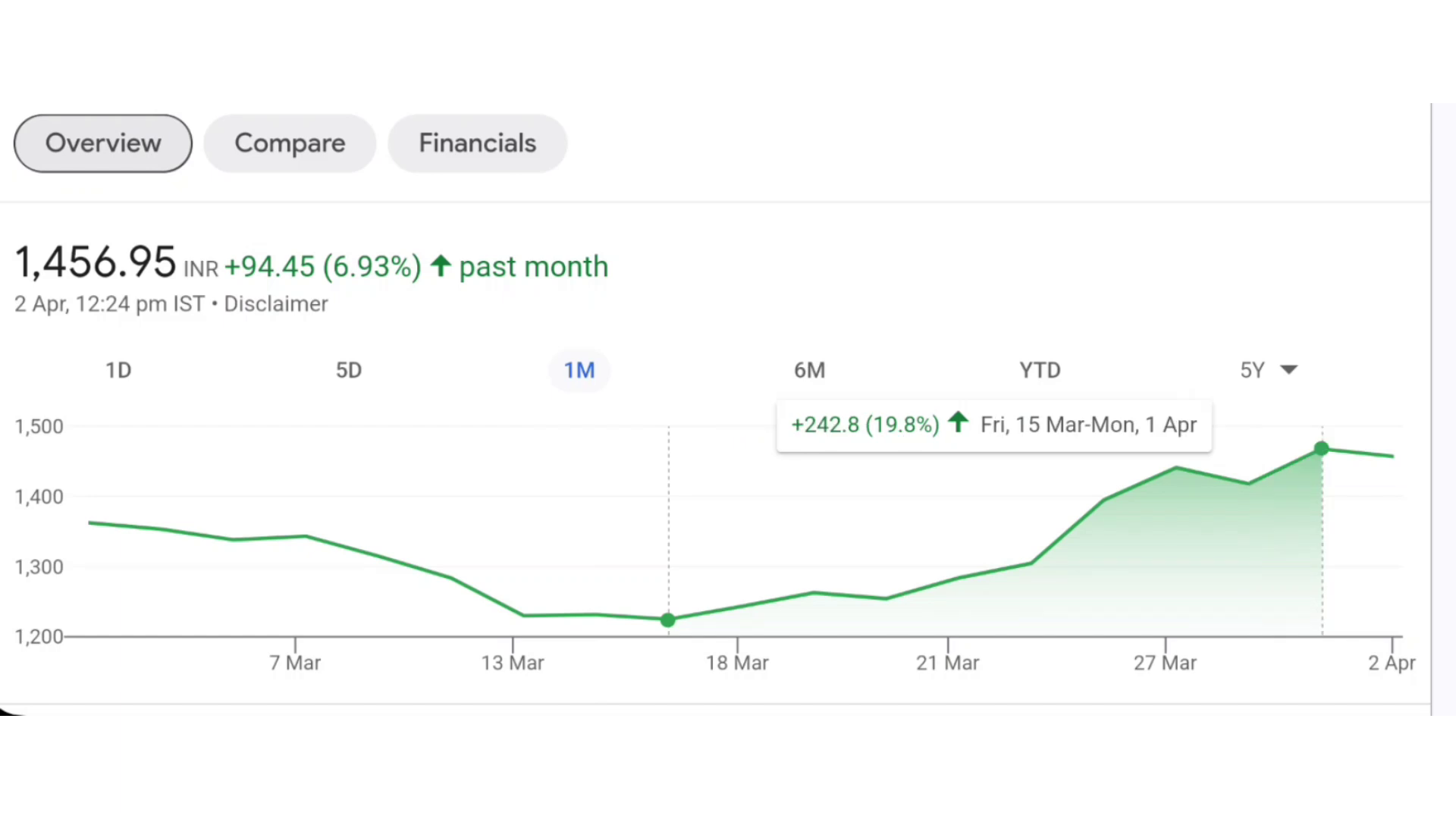

New Age Chemicals Limited is an excellent company that manufactures bromine and lithium-based organic and organometallic compounds. The stock is currently trading at ₹1,249 and has been witnessing a correction for a long time, as the company’s net profits have seen a decline in the past year.

However, things do not always remain the same, and the company’s numbers are expected to improve, leading to a strong uptrend in the stock. The stock is currently available at a 33% discount from its all-time high, and it has seen a good uptrend of 4.26% on January 1st, indicating that a recovery is on the cards.

The company’s business is excellent, but its valuation is slightly on the higher side, with a P/E ratio of 99. Therefore, investors should be cautious while investing in this stock and should allocate a smaller portion of their portfolio to it.

6) Jyoti Resins & Adhesives Limited: Fastest Growing Chemical Stocks

Jyoti Resins & Adhesives Limited is a solid company and is the second-largest-selling wood adhesives brand in India in the retail segment. The stock has been under pressure, and many users have commented that they are unsure about what to do with this stock as it is not performing well.

However, it is important to understand the nature of such stocks. They tend to move very fast and also see a significant correction. If you can handle the volatility easily, then you should continue to hold the stock. The company’s fundamentals are strong, with an excellent return on capital employed (ROCE) and return on equity (ROE) of more than 50%.

The stock is currently trading at a P/E ratio of 27, which is an attractive valuation. The company’s numbers are also improving on a year-on-year basis, and the institutional investors have increased their stake in the company, indicating that the company’s future is bright. Investors should remain patient and avoid panicking during small corrections, as the stock has the potential to generate excellent returns in the long run.

CONCLUSION

In conclusion, the chemical industry presents a compelling opportunity for investors seeking long-term growth and stability. The 6 fastest-growing chemical stocks highlighted in this article have demonstrated impressive performance and have the potential to deliver substantial returns in the coming years. By carefully evaluating the company’s fundamentals, valuation, and growth prospects, investors can make informed decisions and build a diversified portfolio that can generate wealth over the long term.

FAQ: 6 Fastest-Growing Chemical Stocks

- Which chemical company do you have the most trust in for long-term wealth creation?

Based on the analysis in this article, the chemical companies that have the potential to deliver substantial returns in the long run are Deepak Nitrite Limited, Navin Fluorine International Limited, and Finotouch Chemicals Limited. These companies have strong fundamentals, experienced management, and are well-positioned in their respective business segments. - How can I mitigate the risks associated with investing in micro-cap and small-cap stocks?

Investing in micro-cap and small-cap stocks requires a higher risk appetite and a long-term investment horizon. To mitigate the risks, it is important to diversify your portfolio, conduct thorough research on the company’s financials and management, and allocate a smaller portion of your portfolio to these types of stocks. Additionally, it is crucial to remain patient and avoid panicking during periods of volatility, as these stocks tend to see significant corrections and uptrends.

Follow https://www.digitalpluto.co.in/ for the latest updates about the stock market.