5 Best Small Cap Stocks

Selecting the best small-cap stocks to buy in today’s erratic market could significantly impact your portfolio. Investors frequently ignore small-cap stocks, despite their potential to produce extraordinary returns and turn into real multibaggers. In this comprehensive guide, we’ll explore the 5 best small-cap stocks that you should have on your radar for potential long-term investment opportunities.

1. JTL Industries Limited: A Powerhouse in Pipes and Tubes Best Small Cap Stocks

JTL Industries Limited is a leading manufacturer of various types of pipes and tubes, including jumbo steel pipes, structural pipes, casing pipes, black steel tubes, and more. As one of the largest producers and the largest section pipe and tube manufacturer in India, the company’s products are widely used in the construction industry, warehouses, airports, high-rise buildings, and other infrastructure projects.

Currently, JTL Industries has four manufacturing facilities with a total capacity of 850,000 MTPA, and the company plans to increase its capacity to 1 million MTPA in the next two years. The company’s client base includes renowned names such as TATA, Suzlon, and Ashok Leyland, among others, to whom it delivers its high-quality products.

Investors who are patient and hold this stock can expect solid returns, as the stock has delivered an impressive 15-fold return for investors over the past 5 years. In the last year, the stock has provided returns of 34%, making it a compelling investment opportunity.

Fundamentally, the stock looks attractive with a P/E ratio of 33, which is not overvalued. The company is debt-free, and its return on capital employed and return on equity are both above 15%, indicating a healthy business model. Additionally, the company has reported strong profit growth, with a 10-year CAGR of 71%, a 5-year CAGR of 51%, and a 3-year CAGR of 78%, showcasing the company’s excellent business performance.

Given the company’s strong fundamentals, growing business, and the potential for continued growth in the infrastructure sector, JTL Industries is a stock worth considering for your portfolio, especially when it’s available at attractive levels in 5 Best Small Cap Stocks

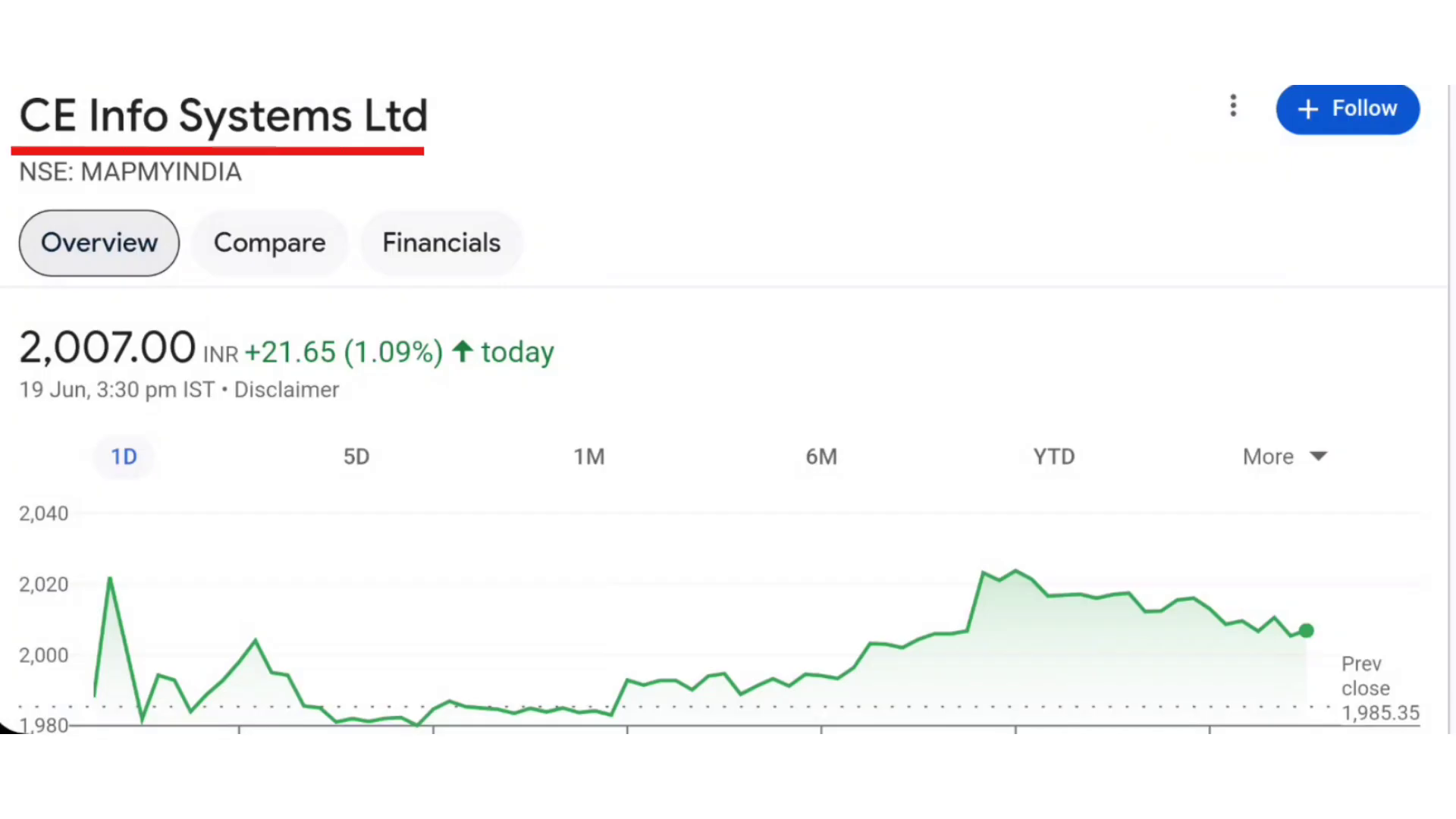

2. CE Info Systems Limited: Revolutionizing the Geospatial and AI Landscape

CE Info Systems Limited, also known as MapmyIndia, is an excellent company with a strong business and management team. The company offers a wide range of services, including map and data solutions, artificial intelligence, analytics, internet of things, navigation, and mobility solutions.

Founded in 1995, CE Info Systems has been at the forefront of adopting new technologies and constantly innovating its offerings. The company currently has an order book of over ₹1,300 crore, and it recently secured a ₹400 crore new order just 3 months ago.

In the past year, the stock has delivered an impressive return of 90%, and in the last 6 months, it has seen a correction of around 44%, providing a good entry point for investors. While the stock was trading at a high valuation of a P/E ratio of 64 when it got listed, the ratio has now come down to 81, which is still on the higher side.

However, the company is debt-free, and its ROCE (Return on Capital Employed) and ROE (Return on Equity) are both above 20%, indicating a healthy business. Additionally, the company has consistently grown its profits, which is a positive sign for the company’s future prospects.

Institutional investors, such as mutual funds, have been continuously increasing their stake in the company, with FIIs (Foreign Institutional Investors) holding 3.93% and increasing their stake from 3.93% to 4%. This suggests that the stock has the potential to deliver good returns in the coming years.

While the stock may experience some volatility in the short term, it is a company with a strong business model and growth potential, making it a stock worth considering for your portfolio.

3. Route Mobile Limited: The Leading Cloud Communications Platform Provider: 5 Best Small Cap Stocks

Route Mobile Limited is a leading cloud communications platform provider, offering a wide range of services such as artificial intelligence, application development, intelligent automation, and various other online and offline solutions.

The company has been in business since 1995 and has consistently delivered solid financial performance. In the last year, the stock has provided returns of 225%, and in the last 6 months, it has delivered 85% returns, making it a top performer in the market.

One of the key reasons for the stock’s strong performance is the large number of orders the company has been receiving in the recent past. The company’s order book stands at a staggering ₹40,000 crore, which is expected to translate into significant growth in the coming years.

Even if the stock corrects to around ₹45, it would still be a good opportunity to accumulate the stock in small quantities, as the company’s fundamentals remain strong and it is expected to receive more large orders in the future.

Investors should keep a close eye on this stock, as it has the potential to deliver substantial returns in the long run. The company’s strong order book, growing business, and consistent financial performance make it a compelling investment opportunity in the small-cap space.

4. Mazgon Dock Shipbuilders Limited: A Powerhouse in the Defense Sector

Mazgon Dock Shipbuilders Limited is a powerful company with a future-focused and strong business model. The company is a leading defense contractor, specializing in the construction and repair of ships for the Indian Navy, Coast Guard, and other maritime agencies.

Over the past 1.5 years, this stock has been on the radar of many investors, and for good reason. The company has been consistently winning new contracts, with its order book now exceeding ₹60,000 crore. This strong order book provides excellent visibility for the company’s future growth and profitability.

In the last week, the stock has seen a surge of 5%, and in the last 6 months, it has delivered 85% returns. While the stock may experience some volatility in the short term, investors should consider accumulating it during dips, as the company’s fundamentals remain strong and it is expected to continue receiving new contracts, leading to further growth in its profits.

Investors who do not already have this stock in their portfolio should keep it on their watchlist, as it is a company with a robust business model, a strong order book, and the potential to deliver substantial returns in the coming years.

CONCLUSION

Remember, investing in small-cap stocks requires a long-term perspective and a willingness to accept higher volatility. By carefully selecting the right small-cap stocks and managing your portfolio effectively, you can potentially unlock significant wealth-building opportunities in the years to come. These are the 5 Best small-cap Cap Stocks

FAQ: 5 Best Small Cap Stocks

- What are the key factors to consider when investing in small-cap stocks?When investing in small-cap stocks, it’s important to focus on the company’s fundamentals, such as financial stability, growth potential, management quality, and competitive advantages. Additionally, it’s crucial to be patient and willing to hold the stock for the long term, as small-cap stocks can experience significant volatility in the short term.

- How can I minimize the risks associated with small-cap stock investments?To minimize the risks, it’s recommended to diversify your portfolio, invest in small amounts across multiple small-cap stocks, and be cautious about investing in small-cap stocks during periods of high market volatility. Additionally, it’s important to do thorough research and understand the company’s business model and growth prospects before investing.

- What is the best time to invest in small-cap stocks?The best time to invest in small-cap stocks is typically during periods of market correction or when the stocks are trading at attractive valuation levels. This allows investors to enter the market at lower prices and potentially benefit from the long-term growth potential of these stocks.

- How can I track the performance of small-cap stocks?To track the performance of small-cap stocks, you can monitor financial news, industry reports, and stock market indices that focus on the small-cap segment. Additionally, you can use stock screening tools and financial websites to stay informed about the latest developments and performance of small-cap companies.

Follow https://www.digitalpluto.co.in/ for the latest updates about the stock market.